Options Trading Knowledge Test iOS

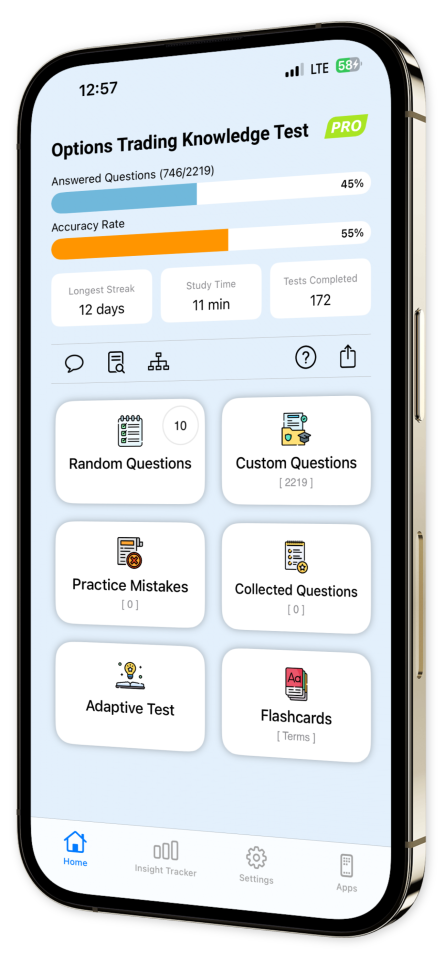

Master the world of options trading with 'Options Trading Knowledge Test'! Dive into a comprehensive testing environment that prepares you to tackle options trading exams with confidence and ease. Our app offers a robust selection of practice questions tailored to cover every critical aspect of options trading, ensuring you're fully equipped for your exams and real-world trading challenges.

Key Features:

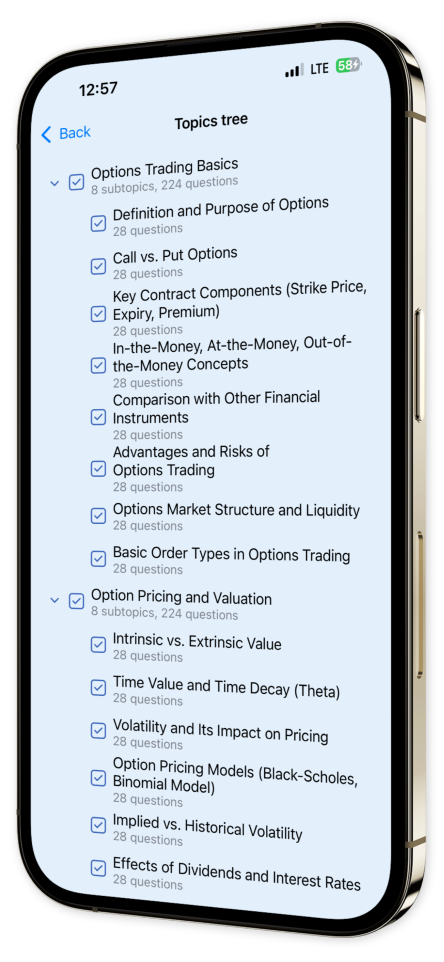

Extensive Question Bank: Delve into hundreds of meticulously crafted practice questions that encompass all essential topics in options trading, providing a well-rounded preparation experience.

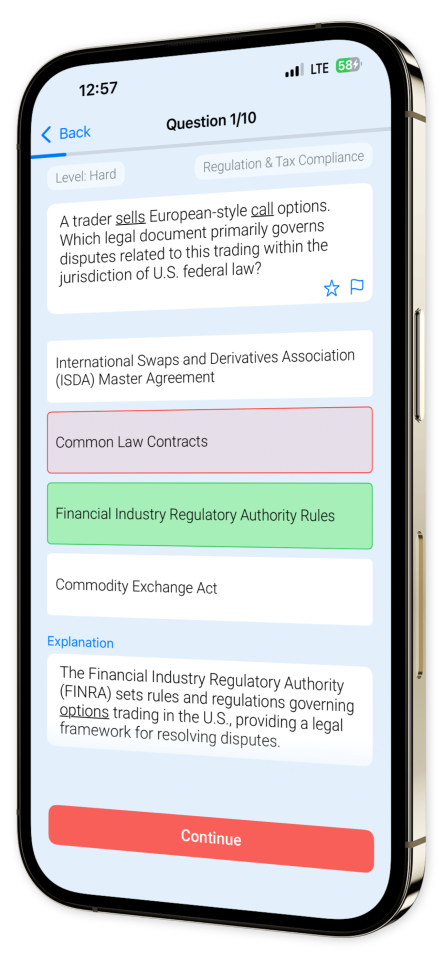

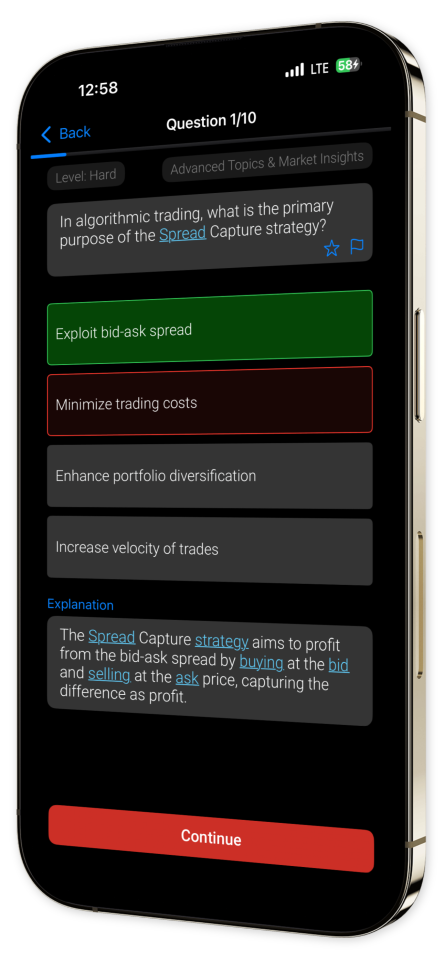

In-Depth Explanations: Each question is accompanied by a detailed rationale, offering insights and clarifications to solidify your understanding and enhance question comprehension.

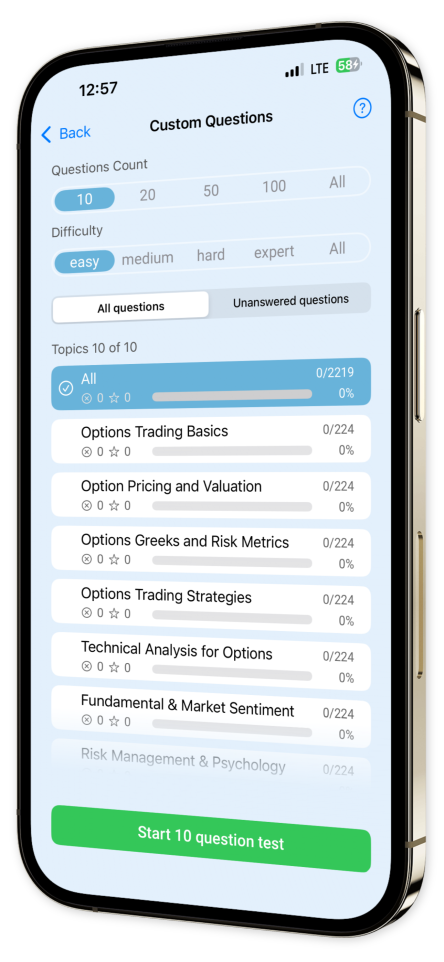

Custom Test Creation: Tailor your study sessions with customizable quizzes that focus on selected topics and question types, allowing targeted practice in areas you're keen to advance.

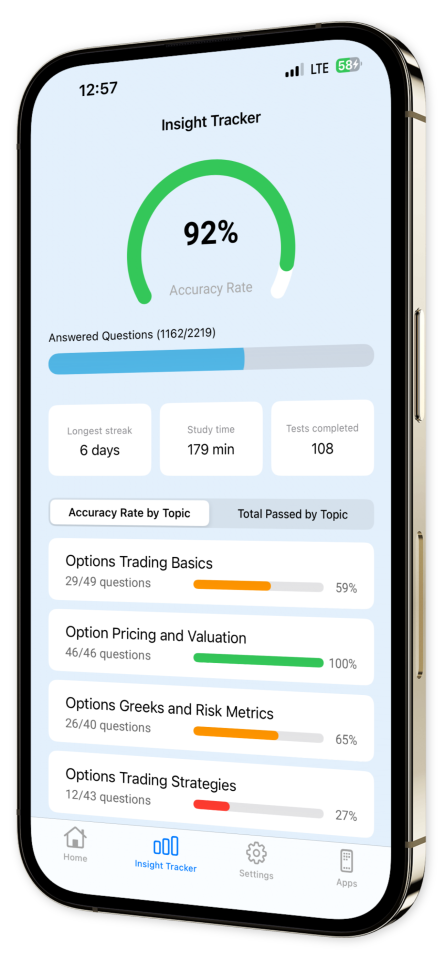

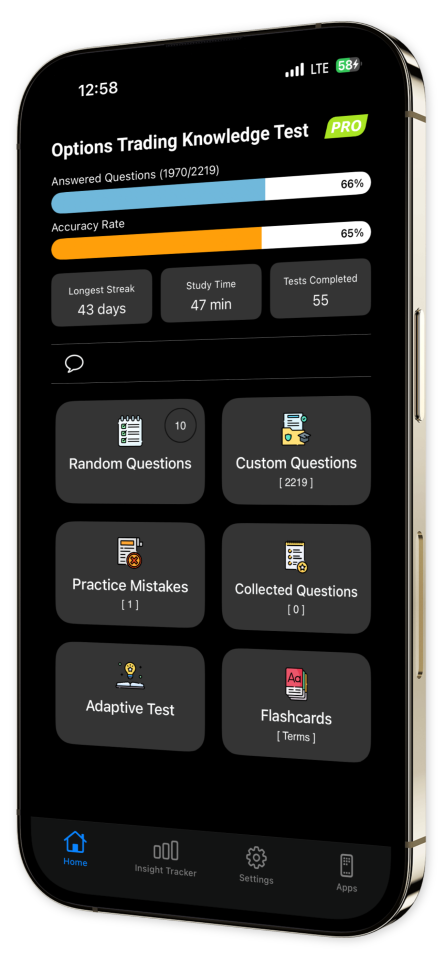

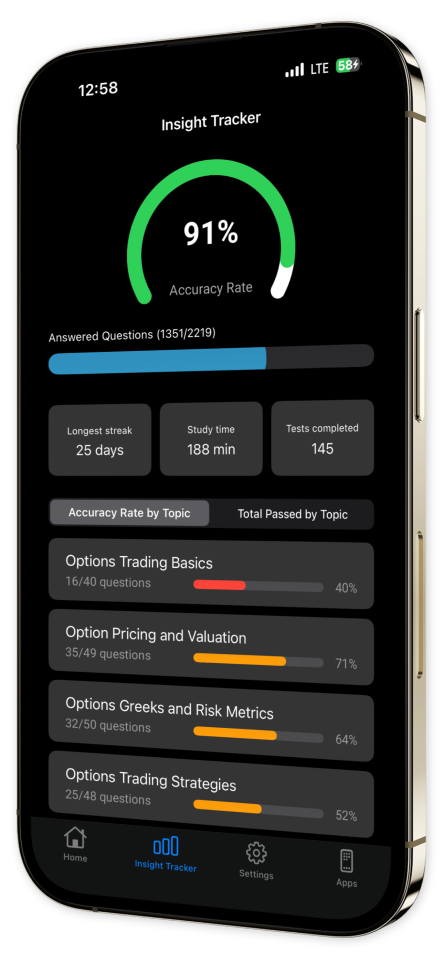

Progress Tracking: Monitor your journey to proficiency with our intuitive progress tracking, which shows improvements and highlights areas needing more attention.

Offline Access: Whether at home or on-the-go, access your study material anytime without the need for an internet connection, making learning flexible and convenient.

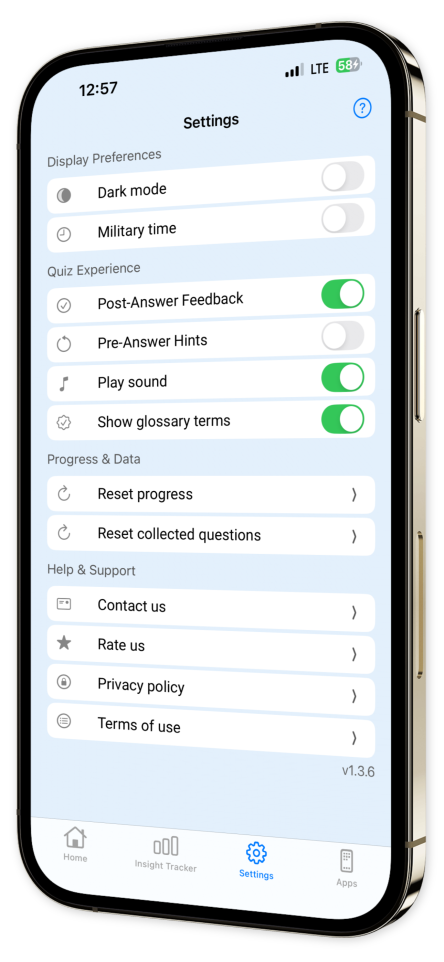

User-Friendly Interface: Experience a sleek, intuitive interface designed to keep your learning streamlined and focused on what truly matters—mastering options trading.

Download 'Options Trading Knowledge Test' now and take a significant step towards becoming a proficient options trader, ensuring you're ready to excel in exams and the trading floor alike!

Embrace knowledge.

Master the markets.

Join a community of committed learners who trust us to elevate their options trading expertise.

Content Overview

Explore a variety of topics covered in the app.

Example questions

Let's look at some sample questions

What is the primary difference between buying a call option versus a put option?

Call options give buying rights, put options give selling rightsCall options are cheaper than put optionsOnly hedge funds trade call optionsPut options have no expiration

Buying a call option gives the right to buy an asset, while buying a put option gives the right to sell.

Considering options market route types, how does an 'All-or-None' (AON) order affect liquidity?

Increases market depthRestricts immediate executionEnhances bid flexibilityEncourages fragmentation

AON orders will execute only if the full quantity is available, potentially delaying execution and restricting liquidity.

What is the primary advantage of using a fill or kill (FOK) order for options trading?

Guaranteed partial fillEnsures immediate execution in full or noneExecutes only at the market closeAllows for better limit than specified

A Fill or Kill (FOK) order ensures an entire order is executed immediately, otherwise, it is completely cancelled.

An option has a Vega of 0.2 and is priced at $10. If implied volatility jumps from 30% to 35%, what's the price now?

$11.00$9.00$10.50$11.50

Volatility increase is 5%. Option price change = 0.2 * 5 = $1. New price = $10 + $1 = $11.50.

If implied volatility is stable, an option's Vega will generally be higher for which maturity?

3-months6-months1-year2-weeks

Vega is generally higher for options with longer maturities because there is more time for the stock price to potentially vary, making the option more sensitive to volatility changes.

An investor buys a put option with a strike price of $45 for $2. Stock is at $40 at expiration. Calculate investor's net profit.

$3$2$5$1

Profit = (Strike price - Stock price) - Premium = ($45 - $40) - $2 = $3.

A trader sets up a calendar spread using calls, buying a 60-day $50 call for $5 and selling a 30-day $50 call for $2. What is the breakeven point at expiration of the short call?

$48$50$53$55

Breakeven for calendar spread: Long call strike - Net premium = $50 - ($5 - $2) = $47, not $53. However, logical approach assumes changes, thus breakeven is $50 due to intrinsic value management.

When interest rates rise unexpectedly, what is the usual impact on implied volatility of options on major indices?

IV typically decreasesIV remains the sameIV typically risesIV stabilizes at a new level

Unanticipated rate hikes can cause market instability, leading to an increase in implied volatility due to heightened uncertainty.

A trader using 10% of capital per position finds correlations between stocks rising. How should they adjust position sizing?

Decrease to avoid compounded risks.Increase to max out correlated gains.Maintain to hedge positions.Switch to random sizing.

Rising correlations mean risks may compound; reducing position sizing helps mitigate this.

What primary function does the CFTC serve in relation to options trading?

Supervises investment advisorsRegulates commodity futuresEnsures fair stock pricingOversees banking activities

The CFTC, or Commodity Futures Trading Commission, regulates the U.S. derivatives markets, including commodity futures and options.